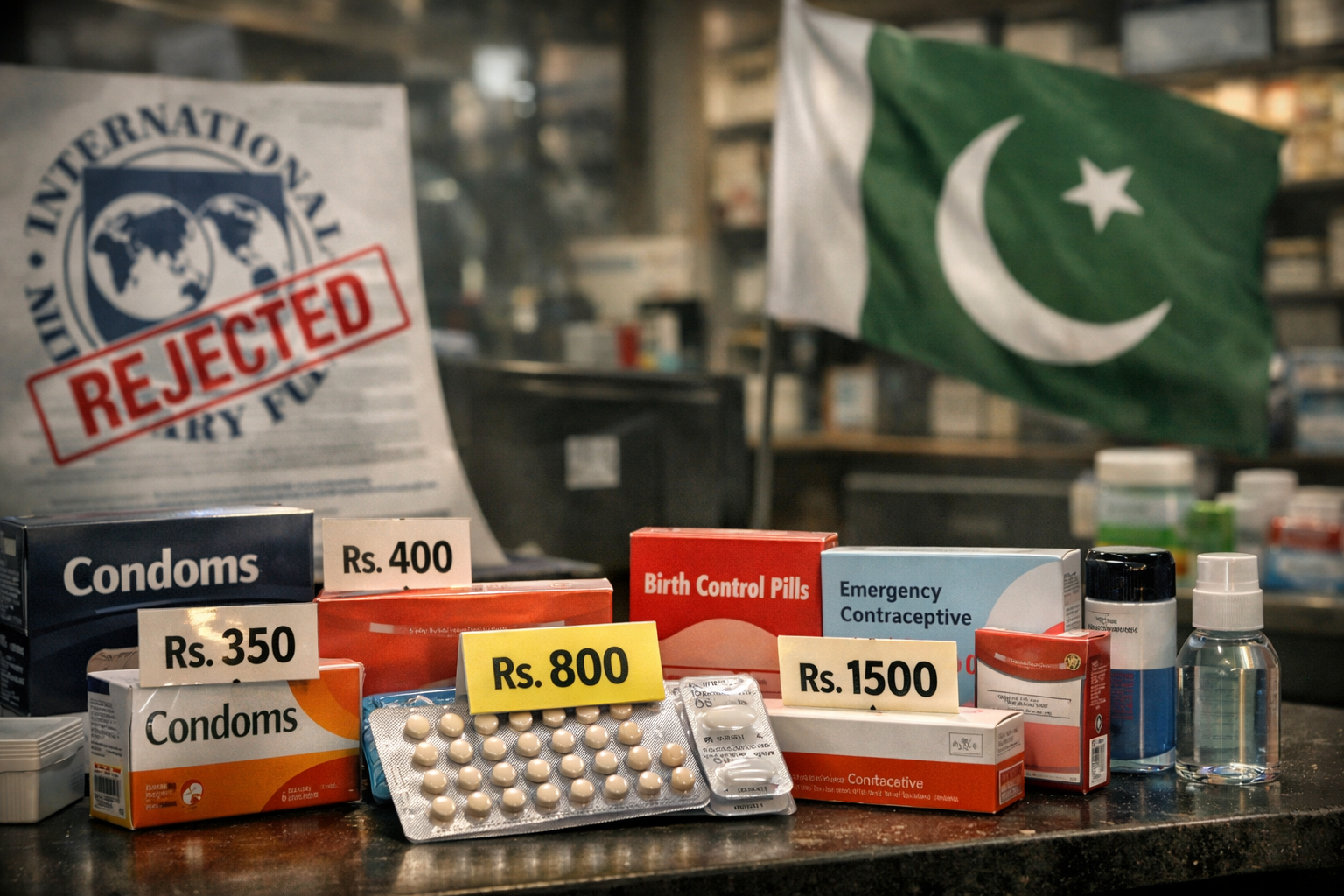

In late 2025, Pakistan made headlines by trying to make condoms and other contraceptives cheaper for its people. The goal was simple: reduce the cost of birth control products so more people can afford them. But the International Monetary Fund (IMF) rejected this request. This decision left many people asking: Why did the IMF say no? In this article, we’ll break down the background, the reasons, and the implications — in clear, simple language that’s easy to understand.

In late 2025, Pakistan made headlines by trying to make condoms and other contraceptives cheaper for its people. The goal was simple: reduce the cost of birth control products so more people can afford them. But the International Monetary Fund (IMF) rejected this request. This decision left many people asking: Why did the IMF say no? In this article, we’ll break down the background, the reasons, and the implications — in clear, simple language that’s easy to understand.

What Did Pakistan Ask For?

Pakistan’s government, led by Prime Minister Shehbaz Sharif, wanted to remove the 18% General Sales Tax (GST) on condoms, contraceptives, and other essential products.

Here’s what they asked:

-

Remove 18% GST on condoms.

-

Cut taxes on birth control pills and other contraceptives.

-

Lower prices to improve family planning access. Pakistan’s rapid population growth and improve public health.

But despite these intentions, the IMF said no.

Why Did Pakistan Want Cheaper Condoms?

1. High Population Growth

Pakistan has one of the fastest population growth rates in the world, growing at about 2.55% per year. That means nearly six million more people are added every year, putting pressure on schools, hospitals and public services.

Making contraceptives more affordable was seen as one way to support family planning and limit the strain on services.

2. Economic Strain on Families

Prices for everyday goods in Pakistan have been rising due to inflation and economic uncertainty. Many families struggle to afford even basic items. Cheaper condoms and birth control could make a meaningful difference for low-income households.

3. Public Health Goals

Access to affordable contraception is linked to better maternal health, fewer unintended pregnancies, and stronger family planning policies. Pakistan’s government saw tax cuts as a way to make these products more accessible.

What Did the IMF Say?

The International Monetary Fund (IMF) rejected Pakistan’s request to immediately cut the 18% GST on condoms and contraceptives.

Here’s the IMF’s main reasoning:

❌ 1. No Tax Relief Mid-Fiscal Year

The IMF explained that tax changes like this cannot be made in the middle of a fiscal year (the budgeting period). Any such changes should only be considered during the next budget cycle for 2026-27.ically applies to countries under its financial programmes, especially when revenue targets are tight.

❌ 2. Impact on Government Revenue

Removing the GST on condoms was estimated to reduce government revenue by about PKR 400–600 million. Pakistan is already struggling to meet its revenue target for the current year, so losing tax income now could worsen budget pressures.

❌ 3. Strict IMF Conditions

Pakistan is currently under an IMF programme that ties financial support to strict economic conditions, including revenue collection and fiscal discipline. The IMF wants Pakistan to strengthen its finances, not reduce tax income.

❌ 4. Risk of Enforcement Problems

The IMF also warned that cutting taxes on these products could make tax enforcement harder and even encourage smuggling, which could hurt long-term tax compliance.

What Does the IMF Programme Mean?

To understand why the IMF had such a strong response, we need to look at the bigger picture:

💼 Pakistan’s Financial Situation

Pakistan’s economy has faced long-standing challenges including:

-

Low foreign exchange reserves

-

High inflation

-

Weak tax collection

-

Large budget deficits

These issues made Pakistan seek help from the IMF. The country is part of a multi-year bailout programme worth billions of dollars. As part of this deal, Pakistan must meet fiscal and economic reforms.

📉 IMF Conditions Include

Some typical conditions tied to these IMF deals are:

-

Increase in tax collection

-

Reducing government spending

-

Structural reforms in government finances

These conditions are designed to make the economy more stable over time. But they also limit Pakistan’s flexibility to cut taxes when it wants.

Why This Decision Matters

⚠️ 1. Higher Prices for Contraceptives

Because the IMF said no, condoms and other contraceptives remain subject to the full 18% GST. This means prices stay high for consumers.

For families struggling with rising costs, this can make it harder to afford birth control.

⚠️ 2. Public Health and Family Planning

Reduced access to affordable contraceptives can affect Pakistan’s family planning goals. When contraceptives remain expensive, many people may choose not to use them, leading to more unintended pregnancies and more pressure on health services.

⚠️ 3. Political and Social Debate

This decision has sparked debate inside Pakistan. Supporters of the tax cut argue it would help poor families and support women’s health. Critics argue that economic survival must come first.

What Happens Next?

For now, nothing changes immediately. Pakistan cannot remove the GST on condoms right now.

However, Pakistan may be able to raise the issue again during the next federal budget cycle (for 2026-27). If conditions improve and revenue targets are met, the IMF might reconsider tax relief issues then.

The government still wants to push for affordable contraception, but it has to balance fiscal rules with social needs.

Conclusion: A Tough Trade-Off

Pakistan’s attempt to make condoms cheaper shows a real effort to support family planning and public health. But because the country is relying on IMF support to stabilize its economy, it cannot make tax changes that could weaken government revenue in the short term.

The IMF’s stance shows a common tension in global finance: social policy goals vs. fiscal discipline. Pakistan will likely revisit this issue when it prepares its next budget, but for now, the decision stands.

Understanding this topic helps us see how economics, public health, and international policy intersect — and why sometimes good intentions run into hard financial realities.