A repo rate cut affects everything — from your EMIs to business loans, industrial growth, and even India’s long-term economic outlook.

What Is the Repo Rate? (Quick Explanation)

The repo rate is the interest rate at which the RBI lends money to commercial banks.

When the RBI reduces this rate:

-

Borrowing becomes cheaper for banks

-

Banks can then offer lower interest rates to the public

-

Loans become cheaper

-

EMIs come down

-

Borrowing and spending increase

This chain reaction helps boost the economy.

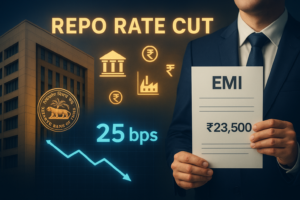

RBI Announces 25 Basis Point Repo Rate Cut

The biggest highlight of this monetary policy is the 25 basis point repo rate cut.

This means:

-

The repo rate has decreased by 0.25%

-

Banks will now borrow at a lower cost

-

Home loans, car loans, and personal loans may soon become cheaper

-

Your monthly EMIs are likely to reduce once banks pass on the benefit

This is great news for the middle class, businesses, and industries that rely on loans to expand operations.

Impact on EMIs: Relief for Borrowers

A repo rate cut usually translates into lower EMIs.

Here’s what borrowers can expect:

-

Home loan EMIs may reduce by ₹300–₹800 per month (depending on loan size)

-

Car and education loans may also get cheaper

-

New borrowers will benefit from lower interest rates

-

Existing borrowers on floating-rate loans will see a reduction soon

For an economy driven by consumption, this relief can encourage people to spend more, which boosts overall economic activity.

Why Did the RBI Cut the Repo Rate?

The RBI carefully monitors economic conditions before making such decisions.

This time, the reasoning is clear:

-

Growth needed a push

-

Inflation is under control

-

Global economic conditions remain uncertain

-

Liquidity in the financial system must improve

By cutting the repo rate, the RBI aims to create a better environment for both consumers and businesses.

RBI Governor Says India Is in a “Goldilocks” Phase

One of the most interesting statements from the Monetary Policy Committee meeting came from the RBI Governor, who said the Indian economy is currently in a “Goldilocks” phase.

What does “Goldilocks” mean?

It’s a condition where:

-

The economy is growing steadily

-

Inflation is low and stable

-

Financial stability is strong

-

Consumer and business confidence is high

This combination is very rare. Most economies either struggle with high inflation or slow growth. But India is currently experiencing both strong growth and controlled inflation.

This makes the repo rate cut timely and strategic.

Why the Goldilocks Phase Is Important

Being in a Goldilocks phase gives the RBI more flexibility.

Here’s why it matters:

-

The economy is stable enough to handle rate cuts

-

Lower inflation gives room for monetary relaxation

-

Industries get a boost due to cheaper loans

-

Consumer spending increases

-

The economy can grow without overheating

This balanced environment is ideal for businesses, investors, and policymakers.

Liquidity Boost for Banks and Industries

The RBI’s repo rate cut also aims to increase liquidity in the banking system.

Liquidity simply means the availability of money.

What the cut will do:

-

Banks can borrow more cheaply

-

Banks will lend more actively

-

Industries will get easier access to funds

-

Manufacturing and production may rise

-

Businesses can expand operations

Higher liquidity is especially helpful for small and medium enterprises (SMEs) that rely on loans to support daily operations.

How Industries Will Benefit

Industries often require large capital investments. Lower interest rates make borrowing cheaper.

Expected benefits to industries:

-

Lower cost of capital

-

Increased investment in factories and technology

-

Higher production levels

-

More hiring and job creation

-

Increased demand across sectors

Sectors that may benefit the most include:

-

Real estate

-

Automobiles

-

MSMEs

-

Agriculture

-

Infrastructure

As industries grow, economic momentum strengthens.

Impact on Common People

The repo rate cut will also impact everyday financial decisions.

What it means for common citizens:

-

Lower EMIs mean more monthly savings

-

New loans will become more affordable

-

Better opportunities for home buyers

-

Businesses may offer discounts due to lower borrowing costs

-

Stock markets may get a positive boost

Overall, a repo rate cut generally leads to improved financial confidence among individuals.

Monetary Policy Outlook: Neutral but Watchful

The RBI has maintained a neutral monetary policy stance.

This means:

-

Future rate cuts or hikes will depend on economic conditions

-

RBI will carefully monitor inflation

-

Growth trends will influence future decisions

-

The central bank is neither too aggressive nor too cautious

This balanced approach ensures economic stability while giving room for future adjustments.

What Will Decide the Next Repo Rate Move?

Two major factors will influence the RBI’s next decisions:

1. Inflation Levels

If inflation rises sharply, the RBI might pause or even increase the repo rate.

2. Economic Growth

If growth slows, the RBI may again consider rate cuts to boost the economy.

For now, inflation remains under control, and growth projections are strong — giving comfort to the markets and policymakers.

Global Context: Why India’s Decision Stands Out

Many global economies are struggling due to:

-

High inflation

-

Slow growth

-

Geopolitical tensions

-

Volatile commodity prices

In contrast, India’s economic position is strong. The Goldilocks phase gives India a unique advantage in steering ahead of global challenges.

Stock Market Reaction

The stock markets generally respond positively to rate cuts because:

-

Borrowing becomes cheaper

-

Companies can expand easily

-

Profit margins may improve

Sectors like banking, real estate, auto, and FMCG often see immediate gains after such announcements.

What Should Borrowers Do Now?

Here are some quick action tips:

-

Check if your bank has passed on the rate cut

-

Compare loan rates before taking a new loan

-

Consider switching loans if your bank is slow to adjust

-

Use the EMI reduction to increase savings

This is a good time to plan long-term financial decisions.

India’s Economic Road Ahead

The repo rate cut is a positive step toward sustaining India’s economic growth. With inflation under control, a strong GDP outlook, and rising consumer confidence, India is positioned for continued momentum.

The Goldilocks phase is not common, and it signals that India is moving in the right direction. The RBI’s careful but optimistic approach shows confidence in the country’s medium to long-term economic prospects.

Conclusion

The 25 basis point repo rate cut is a major monetary policy decision that will impact borrowing costs, industries, banks, and consumers. With India currently in a rare Goldilocks phase, the timing of this cut is ideal for boosting demand, investment, and economic stability.

Lower EMIs, higher liquidity, and a neutral policy stance mean the Indian economy is gearing up for continued growth. As long as inflation remains controlled, the RBI has room to support the economy even further.

This rate cut is not just a financial adjustment — it is a signal of confidence in India’s economic future.